Madhukar (name changed for privacy reasons) was quite excited. His Accountant had just filed his ITR-1 for FY2023 and had informed him that he is going to get a refund of about ₹ 4.42 Laks. He had also assured Madhukar that this should get his refund soon. He had also told Madhukar that typically, he charges 10% of the refund as his fees but since Madhukar was a marquee client, he was willing to settle for about ₹ 25K. So, in effect, Madhukar was likely to get a net amount of about ₹ 4.17 Laks over the next month. The long overdue apartment repainting exercise now appeared doable asap. He also wanted to make sure that the remaining amount was invested in some good instruments and had come home to discuss the same.

As we sat down to discuss, something didn’t seem right and so we decided to do a drill-down into his ITR-1 return. This revealed something absolutely shocking to the two of us.

Situation

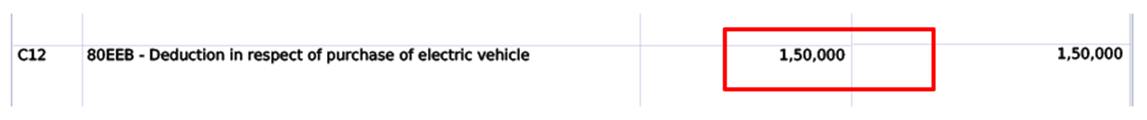

Madhukar’s accountant had submitted his ITR1 for FY23 and had claimed a tax refund of approximately ₹ 4.42 Laks. Nothing abnormal about that except that this means that Madhukar (as per his ITR1) is only liable to pay ₹ 25K as Tax this financial year on a total income of approx. ₹ 23 Laks. (Or about 1% Tax)

Background

Madhukar is a close friend of mine for several years. He works as mid-level manager at a multinational firm that is into industrial engineering.

- His family consists of his wife and 2 children (one of whom is in college and other is in high school). Both his parents are no more.

- He is a man of impeccable integrity who strongly believes in karma and doesn’t want a penny more than what he deserves.

- He earned a gross salary of approximately ₹ 23 Laks in FY23

- As per his Form 16, his firm has deducted a total tax of about ₹ 4.68 Laks for the financial year. His Tax liability works out to approx.20%

- He doesn’t have any outstanding housing loans.

- His PF/PPF contributions have helped him to get the maximum benefit of ₹ 1.5 Laks under Section 80C.

- He has a personal Mediclaim policy for which he has paid a premium of approx. ₹ 29K which should have helped him to get deductions of about ₹ 25K under section 80D.

- He didn’t have any other major investment redemptions and thus it should have been a very simple and straightforward IT Return.

This year, Madhukar and several of his colleagues had been introduced to a new Accountant who had rolled out an interesting offer to them for filing the IT returns.

- He would not charge them a penny for filing the returns, but they would have to pay him 10% of the proceeds if they get a refund from the Government. Further, he would also take care of any downstream queries or questions that would come from the department.

- He had prepared the return and filed the same by logging into the income tax portal using the OTP that would have come to Madhukar’s mobile.

- As mentioned above, the filed ITR1-return had put in a claim for refund of ₹ 4.42 Laks with a total tax liability of just ₹ 25K.

- This meant that if the return gets processed, Madhukar would have paid a net income tax of just about 1%

and that he would reclaimed 99%

of the tax that his firm had deducted as part of the year- long payroll processing.

Assessment

At this stage, my bull-shit meter started swinging wildly. It is quite strange that a leading multinational would done this much of miscalculations on the tax liability despite Madhukar having submitted proof of all his other tax saving measures. As we dug into the filed ITR-1 form, here are the items that came to light.

Issue 1 :

Home loan interest for a non-existent home loan

Issue 2 :

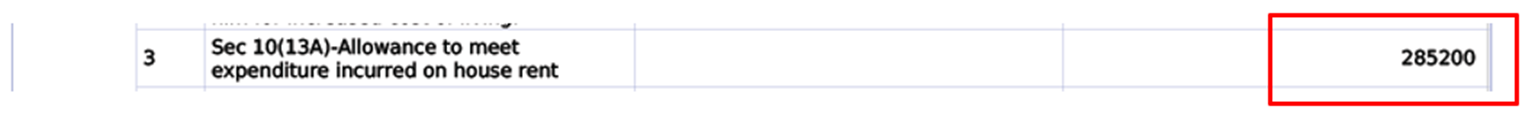

HRA Allowance for a person living in an own house

Issue 3 :

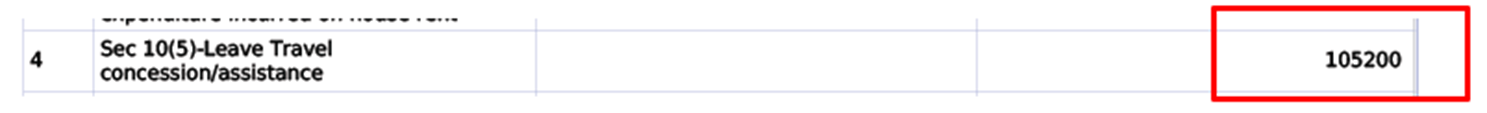

LTA Allowance for non-existent travel

Issue 4 :

Retirement leave encashment Allowance for an actively employed person.

Issue 5 :

Claim of deduction on NPS for a non-existent investment

Issue 6 :

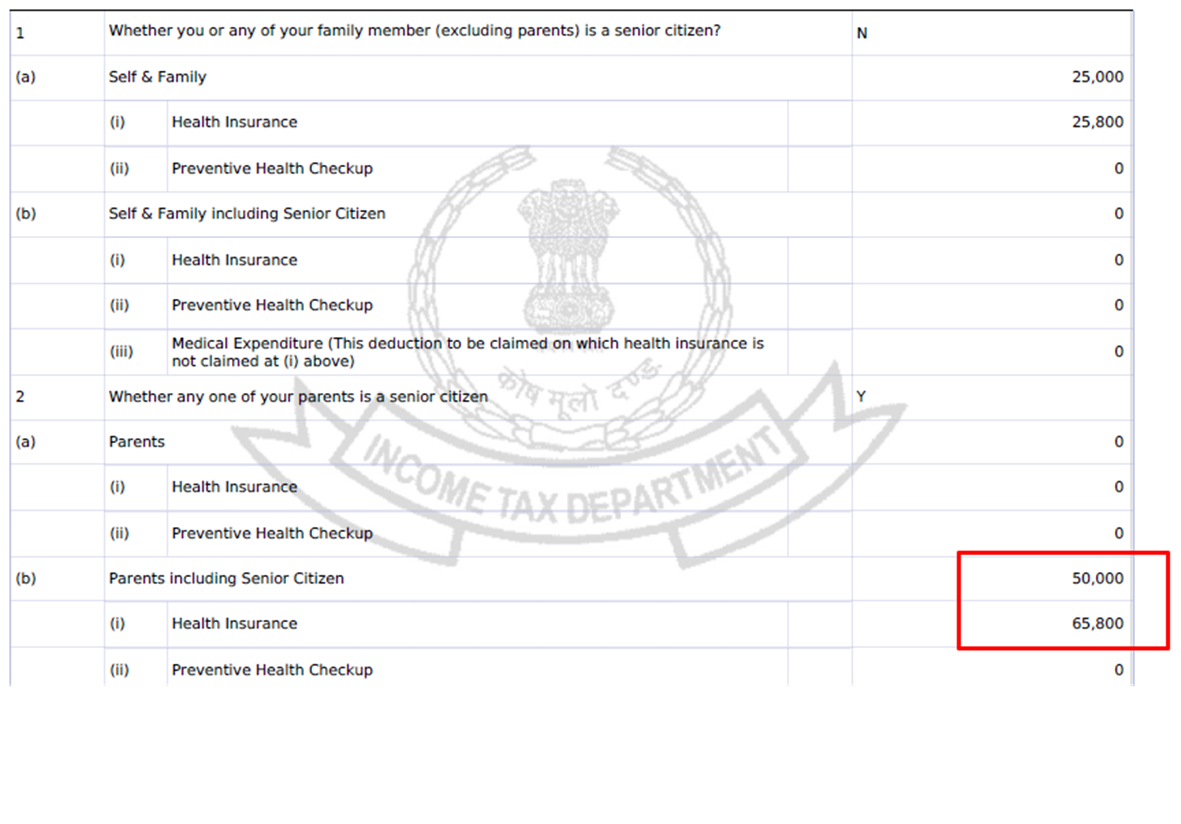

Claim of deduction on Medical Insurance premium for a long-dead parents

Issue 7 :

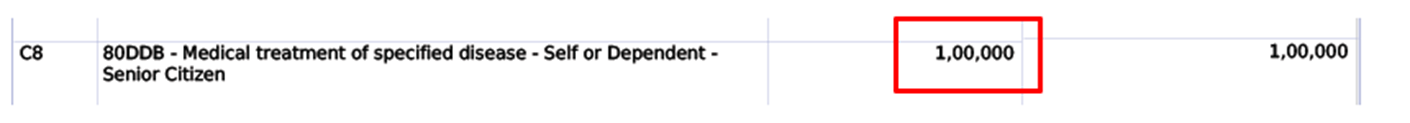

Claim of deduction on medical treatment for a non-existent disease

Issue 8 :

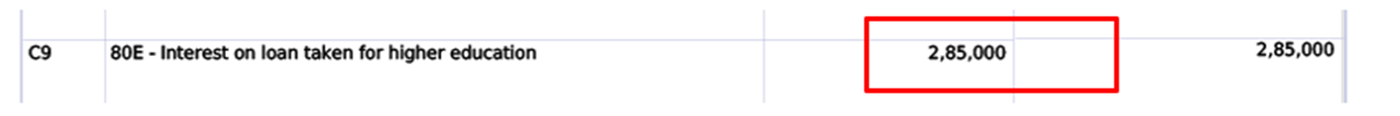

Claim of Interest on non-existent higher education loan

Issue 9 :

Claim of deduction on non-existent electric vehicle

Summary

So overall, the accountant had fraudulently reduced the taxable income from ₹ 23 Laks to ₹ 5.61 Laks

Finally, the accountant had also submitted this assessment as a self-assessment return without filling the TRP data. This means that the entire liability of this return just lies with Madhukar.

Conclusion

Obviously, this investigation completely killed Madhukar’s balloon. When he confronted his accountant, that guy had the gall to say that,

- Everybody else is doing this.

- In case, you get an enquiry from the IT department, I will handle it. I have got insiders in the IT office who will help us get over these enquiries.

- We also have readymade supporting documents for all this (i. e. forged documents)

- We have been doing this for a large set of employees at another Auto major in Chennai and hav been able to get things done without a whisper.

The conscientious man that Madhukar is, he immediately fired this guy and quickly filed a revised honest return under which, his claim had reduced dramatically to about ₹ 5k.

As we were doing this investigation, a similar scam has been uncovered in Hyderabad.

This incident throws up some appalling trends that these corrupt accountants (maybe in cohort with some corrupt IT officials) are undertaking.

- They are targeting employees in the middle-income range (about ₹ 10 Laks to ₹ 30 Laks range)

- Enticing them with false promises of refunds with a false promise of “skin in the game” (I don’t want any money if you don’t get any refunds)

- They are taking advantage of the fact that one doesn’t have to provide supportings unless there is an enquiry from the IT department.=

- Last but not the least, they are taking advantage of the fact that most people don’t take the effort to understand their returns.

This issue is going to get pronounced in the coming year where companies are using the new tax regime as default, and it is left to the taxpayer to do the reconciliation with old tax regime at the time of filing returns. The amount of these frauds is going to increase manifold. Data indicates that close to 50% of the returns are ITR-1 returns and thereby it is important for the government to take ahead of the curve in curbing this menace. The government needs to crank up its analytical engine to investigate pockets of such returns and then figure out ways to curb this menace. One suggestion of IT Sleuths is to do the following

Group taxpayers (especially those filing ITR-1) by TAN No of the employer and see if there is a cluster of people claiming high refunds against a particular employer. This will indicate that there is a fraudulent accountant gang at work.

It is also imporant for the tax payer to realize that “Ignorance is not bliss” in the eyes of the law. Taking advantage of the various sections to reduce the tax outflow is smart and definitely legal. However providing false information or false documentation is absolutely illegal even if it is filed by the accountant. So here are a few things to keep in mind. Also remember that the penalties for fraudulent returns are quite steep and the these can some time go upto 45x times of the fraudulent amount. Below are a few simple tips for taxpayers

- Log into the efiling portal with your PAN Number and get familiar with it. The portal has become a lot user friendly over the last few years and will give a good vide of your Tax landscape

- Take some effort to understand the following statements

- Form -16 issued by the employer

- Annual Information Summary (AIS) that is issued by the IT Department which gives a full view of all transactions tracked by your PAN Number. It is ia one stop shop for understanding your entire history during the year.

- Tax Information Summary (TIS) which is similar to AIS and has some further details on tax deductions

- Form 26AS which is similar to TIS ad cotains important information about tax deducted/collected and deposited with the government tax authorities by the authorised deductors/collectors. A taxpayer can view all financial transactions involving TDS/TCS for the relevant financial year in Form 26AS.

- Try filing your returns by yourself or through a known entity called ClearTax, Taxbuddy, myITReturn etc.,

- If you still prefer to hire an accountant, make sure that you are paying a flat fee for the work. If someone is charging you a percentage of refunds, it is very likely a scamster. Also if he is going to directly file your return, ask the accountant to provide the TRP details which is neccessary if you are using another person to file your return

- Either ways, please take some time to check the completed form before it is submitted. If there is a huge refund being claimed, please make sure that you take time to understand why you are getting the refund